Founder’s Note

It was always my dream to build a company that contributes to the nation’s interests. To create products for the Indian market which resonate with PM Modi’s call for ‘Atmanirbhar Bharat’. Today, I can proudly say that we are not only in 100% compliance with India’s call for Make in India but have taken it a step further – Made in India. Made for the world..

About Us

Welcome to D-lyft India — your trusted partner for premium alloy bicycle frames.

Known for our advanced manufacturing facility and cutting-edge technology, we specialize in OEM production of high-quality frames for top bicycle brands across India and beyond.

Our Vision

To become India’s most innovative and trusted manufacturing powerhouse — engineering world-class solutions in event infrastructure, mobility, and industrial fabrication, while championing quality, customization, and global scalability.

Our Mission

Our mission is to become India’s leading manufacturer of high-quality premium bicycle frames and bold aluminum truss structures, while honoring outstanding leaders and professionals who inspire progress and set an example for the nation.

Glimpses Of D-Lyft Headquarters

D-Lyft Frames

We specialize in premium alloy bicycle frames and components, proudly serving as India’s first OEM supplier of lightweight, durable alloy frames.

Giant Productions

Turning the impossible into reality with exceptional events, driven by the industry’s best management and technical teams for flawless execution and unmatched creativity.

Lucifire Bikes

Lucifire Bikes offers a wide range of premium bicycles with high-quality alloy frames, delivering unmatched durability, style, and performance for riders who demand excellence.

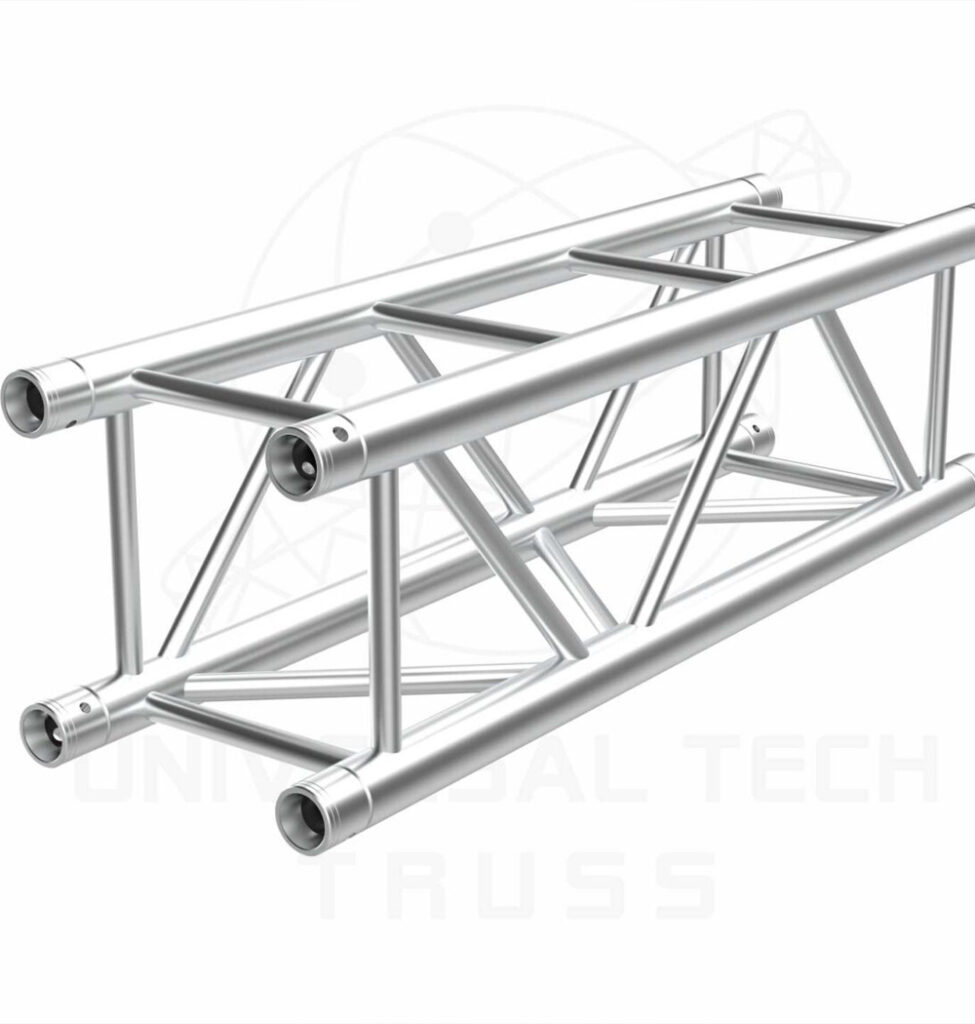

Giant Truss

Giant Truss is a leading manufacturer and global supplier of aluminum trusses and related structural solutions, proudly based in India.

Our Ventures

Our Board Members

Arvind

CEO

Akshay

VP Sales & Marketing

Ashish

Director

Niky

Sales Head

Nitika

HR Head

Our Flowless Process

Research

Develop

Testing

Launch

Our Valuable Clients

Contact Us

Address

- Khewat no-331, Khatoni no-344,Vpo kahni 7 1/2 biswa 77 Rohtak Haryana 124303

- +91 9817167418

- 1800 890 3035

- info@dlyftindia.com